Do you know…

- how much every customer is worth to you?

- how much you should spend to gain a new customer?

- your retention cost for existing customers?

- how to reduce your churn rate?

- how to calculate Customer Lifetime Value (CLV)?

If you answered “no” to any of these questions, you need to read this simple guide.

Retention Value

“Acquiring New Customers Can Cost 25 Times More Than Retaining Them”

(Harvard Business Review, 2016)

After a customer relationship is established, his value will increase the longer you manage to retain him. So, get to know your audience – what they want, at what price, and at what frequency. Over a year’s time, a statistical metric will emerge, which enables the prediction of the Customer Lifetime Value (CLV).

Customer Lifetime Value Definition:

- The CLV is the prediction of the net profit attributed to a customer’s relationship for the lifetime of their relationship with a business.

- The present value of the future cash-flows attributed to the customer during their entire relationship with the company

This measure is the maximum amount you can spend on retention, for the duration of your customer’s relationship. If the business spends the full CLV on retaining each customer, this will produce zero profit. Therefore, striking the right balance is paramount, as the less you spend – the more you will earn, but if you underspend – you are more likely to lose the customer.

This guide shows how to predict the maximum amount a business should spend to retain its customers.

So how do you predict the maximum amount a business should spend to retain your customers for profitability and sustainability?

There are 2 different approaches to calculating CLV, depending on what results from a business is seeking and how much data they have:

The Simple Approach – Linear Fixed Assumptions

The basic approach for measuring CLV: Average Order Value X Average Margin X Amount of Purchases per Year X Annual Retention Rate X Lifetime (in Years)

Average Order Value: Average amount in ($) the client spends on orders

Average Margin: Average amount of profit margin of the business per sale

Amount of Purchases/ Year: # of times the clients order from this business

Annual Retention Rate: Average retention rate is (1-Average Churn Rate)

Lifetime: Average amount of years the business retains each customer

The Average Retention Rate is (1-Average Churn Rate).

I.e.: In the simple model we assume that the future churn rate is linear and equivalent to the churn rate of the first year. You might want to deduct a coefficient for unexpected churn in the first month.

Example: Your client bought your product for $50 in February, $30 in August, and $40 in November.

This means you had an average of 3 purchases over the year for an average price of $40 = ($50+$30+$40)/3

Furthermore, you should assume two more things:

1. How many years the client will stay with you on average

2. Your average gross margin for your product

Assumptions for this example:

1. 20% of your new clients leave during this year = 20% average churn rate

2. -> Annual retention rate = 1- churn rate = 1-20% = 80%

3. Average client stays for 5 years with the business

4. Average profit margin is 25%

Customer Lifetime Value = Avg Amount x Avg # of Purchases x Retention rate x Margin x Lifetime

CLV = $40 x 3 x 80% x 0.25 x 5 = $120

A CLV of $120 would allow a budget of up to $120, to retain each client over a 5-year average lifetime. And if you spend less and retain him longer – you make a bigger profit!

Actual Vs Average

In comparison to the Simple approach, using the actual figures per customer determines a more accurate lifetime value.

You will substitute the average amounts with the total of the actual amounts.

This approach is more common for long-standing businesses, which can utilize supported data over a longer time frame. It is also common to use the real retention rate; as they often change from year-to-year. Substitute these stats in the above formula.

These substitutions will provide a more accurate lifetime value. Now, you are able to strategize which customers to take on and how much you’re willing to spend to retain them.

The Actual Cost

For a more comprehensive approach, you can deduct marketing and acquisition costs from your CLV.

To determine acquisition cost, calculate the total amount spent over a period of acquisition time. Divide this amount by the number of new customers acquired during the same period.

This approach is useful for assessing acquisition strategies and planning new and more effective approaches – while keeping in mind the potential profit of a client over the whole lifetime period and the amount necessary to retain customers.

CLV Applied

Use your customer’s lifetime value metric to revamp retention strategies. You have the ability to target your audience efficiently and successfully provide them with what they’re looking for – when they’re looking for it. In turn, you grow their CLV, loyalty, and your bottom line!

So Now, We Know Whom To Target And Where To Bolster Our Budget Allocation. Go Get ‘em!

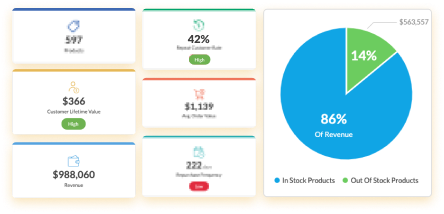

As we know, at AdScale, how hard it is to find new customers and retain them, we have built powerful tools to assist you in both! Ask us about our free audit report which can assist you to retain customers, as well as attract new ones!

Go to adscale.com and try our 30-day free trial

For an in-depth product walkthrough – schedule a demo today!

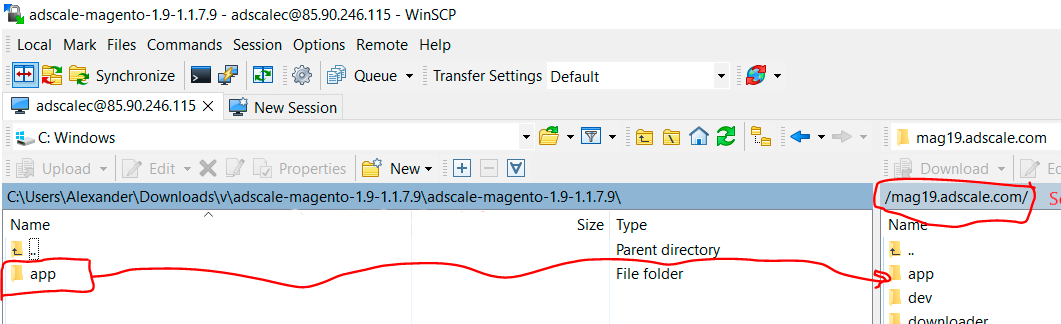

,

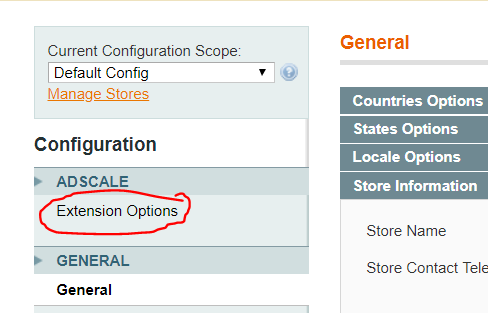

,